Sam Dallyn ne travaille pas, ne conseille pas, ne possède pas de parts, ne reçoit pas de fonds d'une organisation qui pourrait tirer profit de cet article, et n'a déclaré aucune autre affiliation que son organisme de recherche.

University of Manchester apporte un financement en tant que membre adhérent de The Conversation UK.

Voir les partenaires de The Conversation France

Syriza, now on the verge of a historic election victory in Greece, has risen dramatically as an electoral force on the back of a plan to write off debt and end austerity. However, talk of the party introducing a radical Marxist ideology is wide of the mark. In fact, the party’s plan can be seen as an extension of stimulus-based economic policies.

That said, if Syriza were to be elected it would indeed be one of the most left-wing governments ever elected among Europe’s largest economies. Perhaps even since the Spanish Popular Front in 1936 that was toppled by Franco in 1939. Syriza’s decision-making congress consists of elected members from 491 broad left organisations.

But the Marxist credentials of Syriza are arguably more rhetorical than practical. A number of Marxist economists have been closely involved in Syriza, including the chief economist John Milios and the advisor Costas Lapavistas. Both Lapavistas and Milios subscribe to Marxism as a form of economic analysis rather than as a set of definite policy prescriptions. Syriza’s political proposals are rather more pragmatic.

Paul Mason has become one of the most incisive UK commentators on Syriza in recent months. As he has noted, there are two key initial proposals that the party is pushing for: halving the debts to the IMF and the EU, and an end to Greece’s economic austerity.

Greek austerity has led to public sector wage cuts of 20% and cuts to the monthly minimum wage of 22%. These measures have had no notable effect on increasing employment. Greek austerity has helped to create a youth unemployment rate amongst those aged 15-24 of 58.1% in 2014. In light of this, ending austerity appears to be a social need rather than something that only a party on the “extreme left” should advocate.

Why then is Syriza’s policy agenda seen as radical? Actually this tells us less about its agenda and more about the state of centre-left parties in Europe. Syriza seems radical because centre-left parties have moved so far towards a pro-private enterprise position. European centre-left parties when in power have opted to extend the role of private finance in shaping economic policy. The New Labour project led by Tony Blair in the UK was one famous example of this trend.

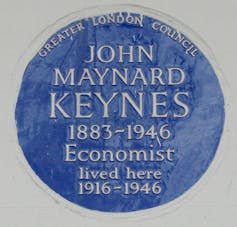

While Syriza does have more radical currents, its programme is in fact broadly aligned with the ideas of John Maynard Keynes which briefly came back into fashion following the 2008 financial crisis, only to be quickly forgotten again.

But Syriza has focused on an aspect of Keynes’s economics that has been neglected by governments. The idea that increased state investment is needed following an economic crisis has received limited attention in policy circles, perhaps because it is clearly contrary to the austerity policy agenda which has taken root in the Eurozone and the UK. It is worth recalling in this context another aspect of Keynes’ thought, that financial markets work best when controlled to help a country’s social and economic development.

This idea of a more regulated financial architecture was strongly advocated by Keynes. A Keynes who helped to devise the post-World War II global economic system at Bretton Woods. The regulated global financial system established at Bretton Woods led to a period of relative economic stability, an arrangement that lasted from 1945-71. Keynes had a strong sense of what was in the UK’s long term rather than short-term financial interests. As he argued:

When the capital development of a country becomes the by product of the activities of a casino the job is likely to be ill–done.

Keynes’s insight was that finance was best seen as a servant rather than a master to whose whims national democracies should be subject. This is still a valuable alternative conception of a regulated financial system. And it is an alternative economic model which a Syriza government may bring us closer to.

As soon as it became clear that Syriza might get elected there have followed warnings of financial catastrophe. These warnings show how far Europe has become subordinate to the dictates of fragile financial markets. The Keynes with a keen eye for how best to regulate international finance is urgently called for now.

And as he noted in 1933:

Knowledge, science, hospitality, travel – these are the things which should of their nature be international. But … let finance be primarily national.

One might have thought these ideas deserve some measure of policy recognition. Particularly in the seven years since the largest financial crisis in recent history. But political leaders have chosen to ignore them throughout Europe. Bringing this aspect of Keynes’s thought into policy debate is vital for any kind of European integration that works in the interest of its citizens.

The key point is that Syriza’s loosely Keynesian programme is not hugely radical. Yet it seems radical given the extent to which capitalist economies have allowed their policy agendas to be shaped largely by the short-term interests of financial markets.

The election of Syriza would force the eurozone into a choice. A choice between addressing the needs of its poorest citizens, or a model that is dictated entirely by the interests of banks and financial speculators. Should it form a government, Syriza will enter into negotiations knowing that if they back down in their call for an end to austerity it may mark the end of any prospect of a socially progressive economic union. But if Germany and others back down it just might be the start of a desperately needed sea change in economic policy.